Powered by Stats, Backed by Logic

Powered by Stats, Backed by Logic

Trading Strategy and Backtesting

Every swing trader or short-term investor faces two crucial questions:

Which stock should I buy?. When should I exit from the stock I bought?

No trader would like to search here and there or discuss with their friends to get an answer. They want to figure out the answer on their own, in their own space, and at their own convenience.

What do you need for that?

A proper Trading Strategy and Trading System.

How and when you are going to initiate a trade and when to exit define a Trading Strategy.

A Trading System is defined by the strategy you use, how you manage trades and risk, and how you control your emotions, fear, and greed.

We need to find an easy and approachable trading strategy, which is a mandatory step. But why do we say it is easy and approachable?

A trader should understand their own strengths and weaknesses to find a strategy that suits them. Success also depends on whether the trader has the patience and stamina to consider multiple factors before initiating a trade. Actually, we don’t need to learn any complicated technical jargon in the initial stage.

We will learn a simple swing trading strategy, an example, that uses technical analysis to help us understand trading strategies, trading systems, and backtesting.

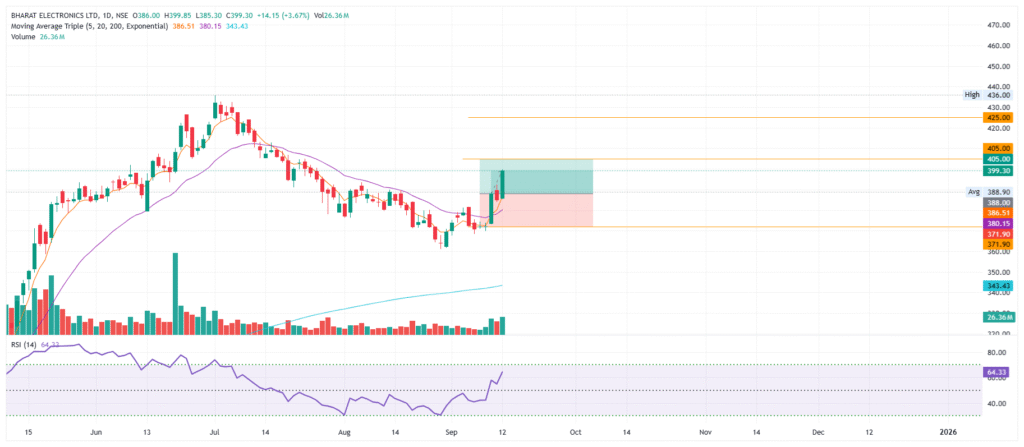

Essentials of StatStock Swing Trading Strategy

Chart time frame: Day

Indicators we need for this strategy:

5EMA, 20 EMA, 200EMA and RSI (14)

- 5EMA shows the trend in the shorter time frame

- 20EMA shows the trend in the medium time frame

- 200EMA shows the trend in the longer time frame

- RSI shows the strength of the trend.

StatStock Swing Trading Strategy

The day candle should be green, indicating bullishness, and it should close above the 5-day Exponential Moving Average (5EMA).

5 EMA should close above 20 EMA, and 20 EMA should close above 200 EMA

RSI is above 50

If these conditions are fulfilled, then we will initiate trade.

Your risk-to-reward ratio should be 1:1.5

You should place your stop loss below the entry candle’s low or swing low.

We got a simple and easy-to-execute strategy, but how will we know which stock is positive with these bullish trend conditions? Is it possible to find a correct candidate from more than 500 stocks in the NSE? To pick the right stock, we need a scanner.

StatStock will provide you with a link to the scanner to pick the right stock.

https://chartink.com/screener/statstock-swing-trading

When you open the link, you will see the stocks that follow our conditions on that particular day. You will also find the backtest data for previous days. You should review all those charts to understand how they performed on those days, and whether initiating a trade would have been profitable or not.

So now, you have learned a swing trading strategy and how to backtest it.

Now comes the Trading system. In other words, we need to create a trading system to make the strategy successful.

How can we frame that?

According to the strategy, we will enter the trade when the green candle closes above the 5 EMA, which is above the 20 and 200 EMA. RSI should be above 50.

(Note: the green candle should form near the 5 and 20 EMA)

We have our predetermined profit and stop-loss levels. But what will you do if the second candle happens to be red? Definitely, you will be in panic.

At this point, most beginner traders usually decide to exit the trade. Because you expect a high momentum after your entry, considering you initiated the trade that followed all the conditions as per our strategy.

Now what to do?

Here comes the risk and trade management.

Don’t panic—wait until either the target level or the stop-loss level is reached. Once we are confident in our strategy after thorough backtesting, we should have the patience to wait until it reaches either the profit target or the stop-loss level.

We will manage the trade by trailing the stop-loss to a higher level near the entry point, or to the target level if the trend continues after the target is reached.

Like any other learning process that involves a step-by-step approach, trading should also be learned gradually in levels.

In short, the steps followed by traders to become a consistent profitable trader can be said as follows:

Backtest – the strategy

Forward test – watching the chart of the selected stocks live.

Paper trading – testing our understanding of the strategy we selected by writing it down in a trading journal.

Test trading – trading with low capital to see how we should manage the trade and its risks by writing it down in the trading journal.

Real trade with your allocated capital.

Hence, we should remember that simply learning a trading strategy is not enough to be a profitable trader; we need to build a complete trading system, journal our testing, and practice on live charts.

Please feel free to contact me on WhatsApp if you need further clarification on the strategy or back testing.